Newsroom

- Source

- Coverage

-

Bloomberg News

February 26, 2019

The Risk Rally Hasn’t Been This Reliant on the Fed Since 2012

On February 26, 2019, Luke Kawa, Bloomberg’s cross-asset reporter, highlighted a recent observation in Sight Beyond Sight that lower real yields were the dominant factor of all major asset class returns in 2019. Neil Azous is quoted several times in the article.

-

Real Vision

April 19, 2018

Podcast - Real Vision Reality Check? The Case For Stocks

On April 19, 2018, Grant Williams and Alex Rosenberg interview Neil Azous, regarding his views on why the stock market is set up for a run in the short-term back to the highs.

Neil discusses forthcoming social network regulation, semiconductors, trade tariffs, higher LIBOR, global growth synchronization, geopolitics, stock buybacks, tax receipts, earnings, volatility, options expiration, the yield curve, crude oil, positioning, and technicals.

-

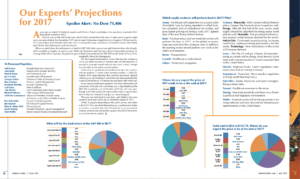

Modern Trader (Futures Magazine)

February 9, 2017

Our Experts’ Projections for 2017

In the March 2017 edition, Modern Trader published its second annual forecasting issue. “Our experts’ projections for 2017” polls a distinguished list of Modern Trader contributors, including Neil Azous, regarding where they expect major market sectors to move in 2017.

-

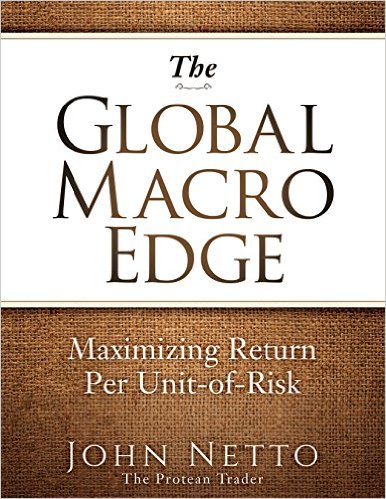

Book: The Global Macro Edge: Maximizing Return Per Unit-of-Risk

October 24, 2016

The Global Macro Edge: Maximizing Return Per Unit-of-Risk

With a proven personal track record of trading experience, John Netto, The Protean Trader, has found great success and personal satisfaction in working the market. Now, in The Global Macro Edge, he pulls back the curtain to reveal the tools and techniques he’s used (and created) to identify and solve the largest problems facing investors, traders, and financial advisors today at a level of transparency rarely seen in books on investing. The Global Macro Edge includes chapters from a talented team of market practitioners as it details how to maximize return per unit-of-risk. And, in the process, it shatters some of the longest held investment myths: More risk equals more return Money always find its most efficient home Emotions are your enemy Diversification is the only strategy you need Today’s markets offer fewer opportunities Compensation should be based on returns The Global Macro Edge presents a logical and robust investment framework that can help investors, traders, and financial advisors profitably navigate global markets by enhancing their operations, analytics, and execution. The Global Macro Edge gives you, the reader, both a top-down and bottom-up approach to Next Generation Investing that is driven by one overarching goal: maximizing return per unit-of-risk.

Contributing authors include: Foreword by Wesley R Gray, PhD, Neil Azous, Jessica Hoversen, Cameron Crise, Darrell Martin, Joe DiNapoli, Fotis Papatheofanous, William Glenn, Raoul Pal, Todd Gordon, Jason Roney, Patrick Hemminger, Bob Savage, Steve Hotovec and Denise Shull

-

Interactive Brokers

July 7, 2016

Interview: Five Critical Investment Implications from BREXIT

Neil Azous, Founder of Rareview Macro and Editor-in-Chief of the Sight Beyond Sight newsletter, sat down with Interactive Brokers to share his views on the critical investment implications from BREXIT, including:

1. How developed markets will now discount a larger geopolitical risk premium similar to emerging markets

2. How the re-evaluation of growth is leading to flatter yield curves around the world

3. How illiquid funds, especially real estate infrastructure, face greater risk

4. How there is a shortage of high-quality US dollar assets

5. Why uncertainty will remain well into the end of 2017

-

Bloomberg Radio

June 9, 2016

Interview: Neil Azous on Bloomberg Radio

Neil Azous, Founder and Managing Member of Rareview Macro, discussed his latest global macro trading views, including the “professional pain trade,” on The Bloomberg Advantage radio show hosted by Oliver Renick and Carol Massar.

This live interview was a follow up to today’s top stories selected by Bloomberg, titled Hedge Funds Trailing Stock Rally May Be S&P 500’s Next Big Buyer, where Neil Azous was quoted multiple times.

-

Modern Trader (Futures Magazine)

May 19, 2016

No New Supercycle In Sight

In the June edition of Modern Trader magazine, Neil Azous provides insight into what key macro factors are telling us about likely trends in commodity pricing moving forward.

-

Modern Trader (Futures Magazine)

March 16, 2016

Crude Oil Correlations

In the March edition of Modern Trader magazine, Neil Azous shows the rolling 60-day correlation between crude oil and five major asset classes: Trade-weighted U.S. dollar, U.S. equities (as represented by the S&P 500), emerging market equities (as represented by the MSCI Emerging Markets Index), the U.S. 10-year Treasury yield, and U.S. 5-year Treasury inflation breakeven spreads (the spread between 5-year TIPS and nominal Treasuries).

-

SiriusXM - Business Radio

February 5, 2016

-

Interview: Neil Azous on SiriusXM Business Radio

Neil Azous, Founder and Managing Member of Rareview Macro, discussed his latest global macro trading views on Behind the Markets, a SiriusXM® radio show hosted by Professor Jeremy Siegel, a world-renowned expert on the economy and the author of the award-winning investment classic Stocks for the Long Run, and Jeremy Schwartz, the Director of Research at WisdomTree, an ETF sponsor. Business Radio (channel 111) is powered by The Wharton School at the University of Pennsylvania.

-

CNBC

February 3, 2016

Neil Azous interview on CNBC with Brian Sullivan: Trading Nation: How stocks will find a bottom

Neil Azous, managing member of Rareview Macro, provides a simple framework, including valuation, technicals, and volatility, to show where the S&P 500 may bottom.